What Best Describes Going Long Buy Position

The second key to building a position is to forget the idea of trying to buy it at its absolute low. A position where there is more than five years to maturity c.

Speed And Velocity Flashcards Quizlet

Theres the distinction between long and buy.

. Treasury note futures contracts are based on a 100000 par value and quoted in points and one-half of 132 of a point. Today the settlement quote is 112265. Think of it as being short that number of stocks and needing to repurchase them.

This is also referred to as going long or buying. A long buy position means that you are purchasing the security with the intent of it going up and then turning a profit when it goes above your entry price. The same distinctions can apply to selling versus short.

The Best Buy started a strategic conversion to a consumer centric operating model which was completed in 2007. For Long Buy occurs first at low price and Sell occurs last at high price. I choose this d.

Summary There are three takeaways from this blog. Closing a trade means terminating an investment. This is when you buy a stock outright initiating a position that.

Investors maintain long security positions in the expectation that the stock will rise in value in the future. Sell refers to selling something you own. When youre trading stocks a long position is one where you buy a stock and try to sell it at a higher price.

For example if you buy amazon stock you would say I am going long on Amazon This means that you are opening a position where you believe that the Amazon stock will rise in value. In forex the purchase you are making is a currency and when you go long you profit when the value rises. It is far more important to focus on trends rather than turning points.

What best describes going long buy position. We review their content and use your feedback to keep the quality high. A position where there is more than one year to maturity b.

A put option increases in value when the underlying decreases and thats good for the buyer. Monitoring your open positions. The opposite of a long position is a short position.

I choose this 3. None of the above. If the stock stayed at the 66 strike or rose above it the value of the put option would decrease.

The Buy occurs first and sell occurs. Buying is what it sounds like you are purchasing the asset. If the price increases in value your position makes profit.

Having a long position in a security means that you own the security. A short is when you borrow and sell a stock or stocks. Stock Purchases and Sales.

Long buildup means more people are expecting the prices to go up and creating Long positions. In contrast a short position. Long not only conveys the action taken but also current ownership and therefore it is much more descriptive than buy.

A short position is generally the sale of a stock you do not own. When you go short you profit when the value falls. Gary decides to purchase 100 shares of stock in Nike Incorporated.

Which of the following describes a long position in an option. When markets are volatile which of the following best describes trading leverages products. If the price decreases in value your position makes profit.

Gary has decided to invest in this company after thorough research. A position where an option has been purchased d. You can think of it as holding a stock for a long time even though it might only be a few minutes.

A long position in traditional trading is when you buy an asset in the expectation its price will rise so you can sell it later for a profit. The Sell occurs first and then Buy. A long position sometimes referred to colloquially as going long occurs when an investor buys an asset holds on to it for a period of time and sells it later.

The Best Buy adopted firms with aligned strategies which can be used as competitive benefits against its strongest competition. On the flip side of the same equation an investor with a short position owes stock to another. Your margin balance at yesterdays close was 1150.

Since the odds are generally in the investors favor over time buying today and waiting for the share price to increase down the road seems to be a good bet. Its the opposite of going short which is when you expect the value to fall. Key Takeaways With stocks a long position means an investor has bought and owns shares of stock.

In foreign exchange trading forex as in all market trading to go long means to buy with the expectation that your purchase will rise in value. Understanding this basic difference is key to next part of article. As a result the overwhelming majority of investors buy long positions in stocks and hope to receive a good return over a long period of time.

The Long Position Buy Low Sell High Buying stocks on a Long Position is the action of purchasing shares of stocks anticipating the stocks value will rise over time. You make money if the price moves either up or down. You can simply look.

All of the above. If an option has 2 of intrinsic value and 105 of extrinsic. Making a long trade doesnt necessarily mean buying a physical asset.

You own one Treasury futures contract that had a closing settlement quote of 113245 yesterday. The obvious choice -- and the most common route -- is take a long position.

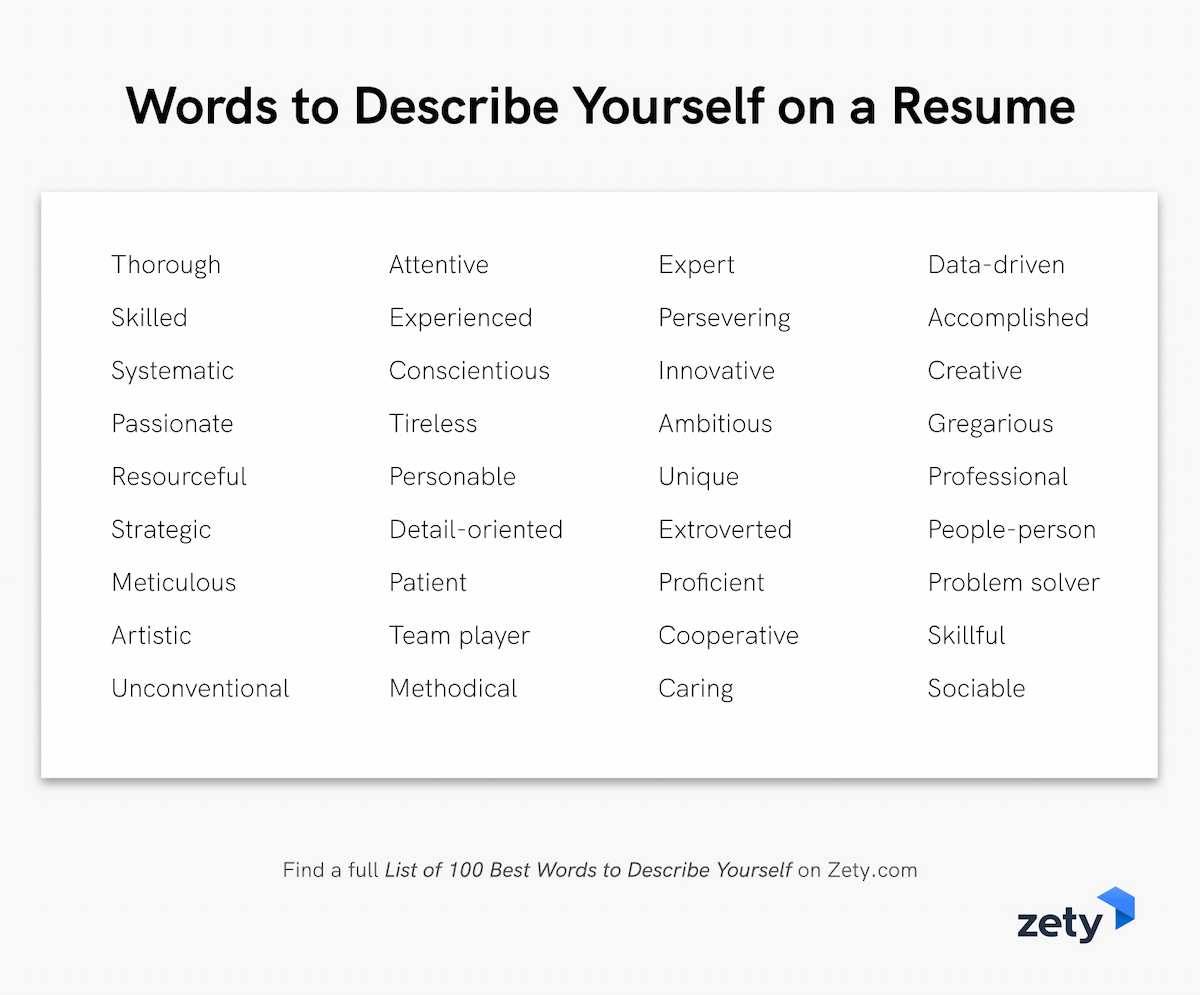

100 Words Adjectives To Describe Yourself Interview Tips

Nohrd Triatrainer 3 In 1 Exercise Bench Exercise Bench Perfect Abs Bench Workout

Which Popular Myers Briggs Personality Best Describes You Enfj Personality Personality Type Quiz Enfj

No comments for "What Best Describes Going Long Buy Position"

Post a Comment